By Will Brinton

Organic farming is grounded in the principle and reality of a vibrant living earth, supporting healthy plant-animal-human communities. This linkage has been encapsulated in the contemporary and somewhat abstract term “ecosystem services,” essentially referring to the benefits humans obtain from natural systems, as formulated in the early work of Paul Ehrlich and Gretchen Daily at Stanford University.

Organic practices, conceptualized and evolved over the last century, seamlessly align as key elements to enhance contemporary interpretation of ecosystem services.

In a nutshell, organic management, which nurtures ecosystem services, involves both avoidance practices (steering clear of ecologically harmful inorganic nutrients and pesticides) and embracing practices like composting, crop rotation, cover cropping and companion bee-friendly planting. In contrast, in conventional farming yield-centric practices dominate and many of these ecosystem services are deemed irrelevant.

The price consumers pay for organic products reflects this extra effort to enhance ecosystem services. Consumers who acquire these products at the asked-for price in the free marketplace show their recognition and confidence in these practices.

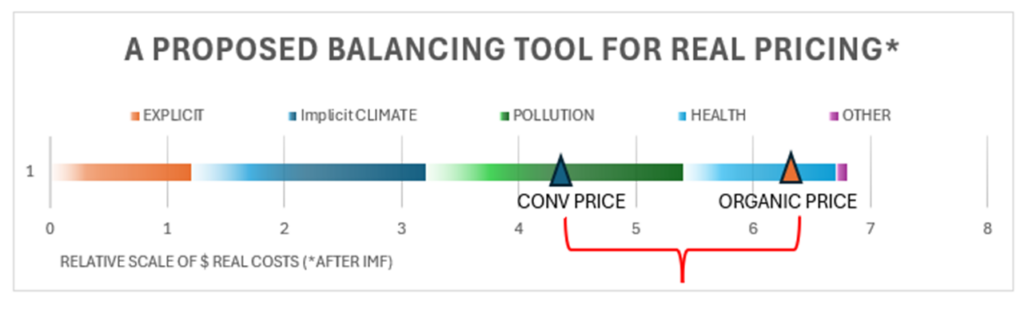

In conventional farming, practices detrimental to ecosystem services are often disregarded (or considered nonexistent), leading to apparent lower food costs. However, these passed-along offsets do possess real value. In a stunning assessment in 2023, the International Monetary Fund (IMF) defined all forms of ignored offsets as environmental subsidies. Like IMF, which reports on worldwide fossil fuel economies, I believe the costs apportioned, in this case to conventional farming, have also been incorrectly calculated. This is underscored by data from geochemist William Schlesinger who showed that the carbon dioxide (CO2) released in production and distribution of chemical nitrogen fertilizer effectively negates any carbon value from crop yields enhanced by the fertilizer. In this case, the CO2 offset in manufacturing nitrogen has not been correctly calculated into its cost and therefore the fertilizer is subsidized to the detriment of farming.

This narrative begins with the response of a particular emerging sector in society to the global threat to ecosystem services. This response involves the initiation of reward programs for carbon sequestration, with a significant focus on farming. After the introduction of the “4 per mille” concept of carbon sequestration in the 2015 Paris Climate Accord, carbon trading markets gained momentum. The idea behind the initiative is a calculation showing that an annual increase of 0.4% in carbon across the world’s arable soils would theoretically offset all global net CO2 emissions.

Through the mechanism of proposed voluntary carbon markets (a recent Environmental Defense Fund report lists 12 voluntary protocols), a broker arranges a payment to a grower for an increment of increased soil carbon, the monies for which to be paid presumably by an industry that is damaging ecosystem services. The broker takes a variable and sometimes large cut of the fees.

But, as I have already mentioned, organic farming, as presented herein, already includes the costs of ecosystem services in its products. Worldwide these products are sold with slight to large premiums because the price to a willing consumer reflects the real cost of the positive environmental-social offsets arranged and fostered by the grower.

At the farm level it is more difficult and therefore more costly to manage soil for enhanced biological activity that could result, for example, in improved earthworm counts, a major ecosystem service. The famous early study by the German Ministry of Agriculture in 1977 found that organic-biodynamic farms had 400% more earthworm counts (among other attributes) when closely compared to conventionally managed farms of similar size and soil type. At that time, the concept of the value for an ecosystem service — i.e., the worms — was not remotely comprehended. Recently, a study in Ireland calculated the positive offset value of just soil organisms and earthworms (maintaining fertility and nutrient cycling) at 1 billion euros per year.

It is essential for all product valuations to be transparently recognized in a real buyer-seller interaction. Therefore, the introduction of a second market, where growers sell a comparable concept of the product to “wrongdoers” (i.e., the carbon emission industry purchasing carbon credits), is inherently flawed.

A significant issue arises as this emerging carbon market disrupts and alters the trust dynamic between growers and consumers. It achieves this by establishing a reward system that favors a third party, namely climate brokers and their clients, that is not involved during the actual provision of the service. An additional and very significant flaw is the questionable ethics: the trade represents a double payment to the grower. Are growers comfortable in explaining this? If the broker were not there to collect, would the transaction ever have happened in a real local market? We are asked to imagine our position selling a soil-grown product in a real marketplace, and then ask for an additional payment for a fractional component of our ecosystem services that went into producing it.

Ethical issues are quickly catching up with new carbon markets. Questionable tactics came to light as Greenpeace’s journal Unearthed documented, in May 2022, a surge in brokerage companies offering low farmgate value for carbon and then selling for high, “all done sitting on a computer making connections … while the farmers were out there working … to keep it alive.” More recently, in January 2023, The Guardian, a British daily newspaper, dropped a bombshell in reporting that more than 90% of carbon sequestration credits sold by Verra, a major certifier of carbon credits, did not represent actual validated carbon reductions (Bloomberg News presented a similar analysis). In this still unfolding scandal, The New Yorker’s Heidi Blake described the path to multiple failures in how carbon sequestration projects launched by South Pole, the world’s largest carbon-offsetting firm, and verified by Verra, were unscrupulously developed, and improperly validated, with evidence of shoddy work overlooked or suppressed — all this resulting in millions of credits sold for carbon reductions that weren’t real. Verra is a familiar name in New England, encouraging growers to plant crops, such as hemp, for brokering carbon credits. A significant number of these vast credit schemes, involving hundreds of millions of dollars annually, are directly implicated in the so-called “carbon neutral” labels advertised for vehicles, airline flights, and products from chocolate to clothing.

One way to achieve the goal of correcting this misuse would be for organic growers, buyers and sellers to collectively consider the inclusion of the authentic carbon value in farm products for the benefit of consumers. This concept could be realized in the form of a label reading something like “Carbon Included” — indicating that the buyer has directly contributed to this, as opposed to a broker’s clients in New York or Zurich.

Obviously, in attempting to build this new perception, opposition may arise from existing carbon marketers and the consulting scientists working with them. I have heard arguments that this critique will depress carbon innovations, turning away sellers — the farmers — who are essentially being offered free money. In fact, organic growers are simply fighting to keep the value of their own efforts and products within their own space. They may need to be prepared to enhance their own tools and methods for substantiation to accurately indicate viable soil carbon levels. They should beware of detractors who may say, borrowing on the recent Irish study, that organic growers are now selling “earthworm credits.”

For nearly a century, organic farmers have consistently invested additional efforts in enhancing soil health, minimizing chemical impacts and revitalizing ecosystem services. It is essential not to isolate and commodify organic farming soil carbon in a piecemeal, reductionist approach. The late Vermont-based organic grower Jack Lazur addressed the potential inequity of emerging carbon markets at a meeting sponsored by Tufts in 2019. He pointed out that during the past 50 years he invested to increase his soil organic matter and therefore is not likely to benefit from the cash offered for new carbon increments. Lazur is correct since carbon is validated from baseline and that in soil it reaches a natural plateau — under organic management it won’t just keep increasing. In this sense, it seems ironic that conventional growers who chose not to pursue climate-enhancing technologies originally may benefit disproportionately. This conclusion is supported by a 2022 IFOAM Organics Europe position paper on carbon farming: “First movers, such as organic farmers, who are already contributing to higher carbon stocks, should not be penalized, as carbon farming schemes are likely to reward ‘additional’ efforts.”

For those interested, the IFOAM paper is a worthwhile read, contending that a market approach to carbon is just the wrong way to do this. The idea that the price of a carbon credit should decide whether a grower chooses to increase soil carbon is viewed as most unfortunate. Or that this price is not being determined by the real cost of sequestration, such as by real farmer efforts, but arbitrarily, from buyers who may be large companies with favorable market advantages. It was just after the IFOAM report came out that we learned how this has played out with carbon operators in America and Europe.

An authentic transaction concerning soil carbon and its value should take place in close proximity to the farmgate, and consumers can expect favorable results. Organic farming is already well-positioned to rightfully claim its credit.

Will Brinton is a soil and plant scientist, founder and emeritus CEO of Woods End Soil Laboratories, and an expert advisor on the Demeter USA Soil Monitoring Protocol Committee. Woods End Lab is a 2023 recipient of a U.S. Department of Agriculture (USDA) grant called IDEA, which is intended to instruct growers on robust soil carbon assessment procedures, in which he will be an instructor. MOFGA is listed as an education and outreach sponsor in addition to Stone House Farms and Stone Barns (New York) and the Somali Bantu Community Association (Maine). References for this article are available by contacting the author at [email protected].

This article was originally published in the spring 2024 issue of The Maine Organic Farmer & Gardener.