Planned Giving: MOFGA Legacy Circle

At MOFGA, we believe that everyone — regardless of income or situation — has the opportunity to leave a gift with a lasting impact, and we welcome you to join our Legacy Circle so that we may celebrate your philanthropic giving.

Thank you for ensuring that MOFGA’s mission will continue well into the future.

For more information about planned giving, please contact Mary Weitzman, director of development and membership, at [email protected] or 207-505-5623.

Anyone who gives to MOFGA via:

- A noted bequest in their will or trust.

- A piece of real estate, gifted either before or after death.

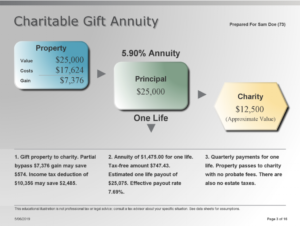

- A Charitable Gift Annuity.

- A noted beneficiary of a life insurance or retirement plan.

- A gift of personal property valued over $5,000.

A bequest is an asset given through your will or trust. By far our most popular form of future gift, it costs you nothing now, and may provide tax savings or help reduce the tax burden for your heirs. You may remain anonymous if you choose, or allow us to celebrate your lasting legacy as a supporter of MOFGA’s vital work for farmers, gardeners and our environment.

MOFGA will receive the gift after your lifetime and apply it to the purpose(s) you specified. Unrestricted charitable gifts are used to support our most important initiatives.

Leaving a bequest to MOFGA in your will or trust is simple.

- Once you determine what particular asset, dollar amount or percentage of your estate you would like to give to MOFGA, you can include it as a bequest provision in your will or revocable trust. You can do this while creating your will or trust, or you can amend an existing one with a simple document (often referred to as a “codicil” to your will). MOFGA can be either a primary or a contingent beneficiary.

- If you plan to restrict the use of your bequest (designating to a specific area or program), please contact MOFGA while drafting your will or trust to ensure your wishes can be met. The more narrowly you restrict the use of your bequest, the greater the risk that the program you want to benefit today won’t be as vital or as relevant when we receive your gift in the future.

- Inform MOFGA of your commitment (this is especially important for gifts of real estate, business interest or other specialized property) to help us ensure your wishes can be fulfilled, while allowing us to welcome you to our Legacy Society with lifetime membership and other rewards.

If you wish to name MOFGA in your estate plan, we should be named as:

The Maine Organic Farmers and Gardeners Association, a nonprofit corporation, organized and existing under the laws of the state of Maine, with the principal business address of 294 Crosby Brook Road, PO Box 170, Unity, Maine, ME 04988.

Our tax identification number is: 01-6048322

For any specific tax questions for your unique situation, we recommend consulting with a qualified advisor before making a gift.

For more information on this program, please contact our director of development and membership at 207-568-6013 or [email protected].

You can name MOFGA as the primary beneficiary of your life insurance policy or as a co-beneficiary.

You can also irrevocably donate your paid-up life insurance policy — please contact us directly about making this type of gift.

Follow these simple steps to make a gift of life insurance:

- Provide now for a future gift by naming the Maine Organic Farmers and Gardeners Association of Unity, Maine, as the beneficiary of a policy insuring your life.

- If you plan to restrict the use of your bequest (designating to a specific area or program), please contact MOFGA to ensure your wishes can be met. The more narrowly you restrict the use of your bequest, the greater the risk that the program you want to benefit today won’t be as vital or as relevant when we receive your gift in the future.

- At death the benefits pass to MOFGA and are applied to our most critical work at the time or the program designated by the donor.

- Inform MOFGA of your commitment, which helps us ensure your wishes can be fulfilled and allows us to welcome you to our Legacy Circle.

To identify MOFGA in your policy, please use the following information:

The Maine Organic Farmers and Gardeners Association, a nonprofit corporation, organized and existing under the laws of the state of Maine, with the principal business address of 294 Crosby Brook Road, PO Box 170, Unity, Maine, ME 04988

Our tax identification number is: 01-6048322

For any specific tax questions for your unique situation we recommend consulting with a qualified advisor before making a gift.

For more information on this program, please contact our director of development and membership at 207-568-6013 or [email protected].

You can make a significant impact to the future of farming, gardening and the environment by making MOFGA a full or partial beneficiary of your IRA, 401(k) or other qualified retirement plan.

The taxes applied to your retirement plan assets may be different than you imagined — in fact, using retirement assets to make a donation and leaving other assets to your heirs often enables you to give more to your heirs.

Follow these simple steps to make this kind of gift:

- Provide a future gift by naming the Maine Organic Farmers and Gardeners Association of Unity, Maine, as the beneficiary of a qualifying retirement plan through a beneficiary designation form. An extra step may be required to designate a 401(k).

- If you plan to restrict the use of your bequest (designating to a specific area or program), please contact MOFGA to ensure your wishes can be met. The more narrowly you restrict the use of your bequest, the greater the risk that the program you want to benefit today won’t be as vital or as relevant when we receive your gift in the future.

- After your lifetime, the remainder or a percentage of your plan passes to MOFGA tax-free and to any other named heirs.

- Inform MOFGA of your commitment, which helps us ensure your wishes can be fulfilled and allows us to welcome you to our Legacy Circle.

To identify MOFGA in your plan, please use the following information:

The Maine Organic Farmers and Gardeners Association, a nonprofit corporation, organized and existing under the laws of the state of Maine, with the principal business address of 294 Crosby Brook Road, PO Box 170, Unity, Maine, ME 04988

Our tax identification number is: 01-6048322

It is also possible to make a current gift using your IRA. For more information, please visit the IRA Rollover page.

For any specific tax questions for your unique situation we recommend consulting with a qualified advisor before making a gift.For more information on this program, please contact our director of development and membership at 207-568-6013 or [email protected].

Graphic courtesy of Bar Harbor Trust Services

For more information on this program, please contact our director of development and membership at 207-568-6013 or [email protected].

MOFGA is a broad-based community that educates about and advocates for organic

agriculture, illuminating its interdependence with a healthy environment, local food production,

and thriving communities. To further its mission, MOFGA may accept gifts of land (otherwise

known as real estate for purposes of this policy). However, MOFGA is not a land trust and will

only accept gifts of real estate that fit within organizational capacity and meet the strategic goals

of the organization.

Gifts of real estate may include developed property or undeveloped property and can only be

accepted with the approval of the Board of Directors. MOFGA accepts donations of real estate

as “tradelands,” where the property is sold on the open market and proceeds are used in

support of MOFGA’s operating programs or endowment. When possible, and if there is an

appropriate land trust, tribe, or other entity interested in the property, instead of a sale MOFGA

may transfer ownership to said land trust, tribe, or other entity for long-term stewardship in

alignment with MOFGA’s operating programs and community partnership goals. Rarely,

MOFGA will consider holding/maintaining a gift of land.

II. In order to accept a gift of real estate, MOFGA will require:

A. Sufficient capital contribution to cover MOFGA’s costs in executing the transaction and

holding the property during that period.

B. A clean Phase 1 environmental assessment, which shall generally be an expense of the

donor.

C. An understanding and acceptance of any restrictions, reservations, easements, or other

limitations associated with the property.

III. Upon receipt of a gift of real estate, in support of MOFGA’s work and strategic goals committed

to equity and restorative land justice, following Board ratification MOFGA may consider:

A. Partnering with and transferring property to a mission-aligned land trust, tribe, or other

entity committed to land justice and land access for Indigenous people and farmers who

have faced generations of disinvestment.

B. Partnering with a mission-aligned land trust to transfer property and sell existing

infrastructure assets to support MOFGA’s ongoing programs.

C. Selling all or a portion of the property to support MOFGA’s ongoing programs and when

designated by the Board, share a portion of the proceeds with a mission-aligned land

trust, tribe, or other entity committed to land justice work.

IV. On rare occasions, an exception may be made where MOFGA would accept and hold/maintain

a gift of real estate if it aligns with MOFGA’s strategic goals. Any such exceptions would be

contingent upon Board approval and may also require an accompanying endowed fund gift to

provide ongoing support for the property, its expenses, and its maintenance.