Gifts that Provide Income

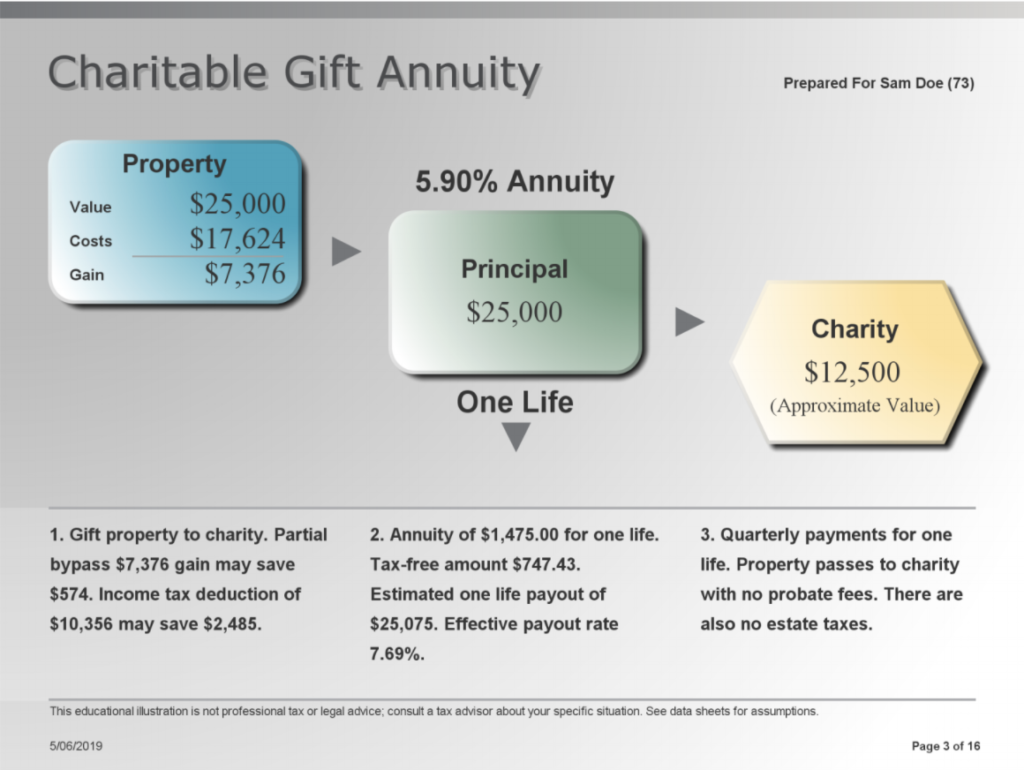

A Charitable Gift Annuity is a combination of a gift to charity and an annuity. For senior persons, annuity rates may be 6%, 7% or even higher. Since part of the annuity payment is tax-free return of principal, the gift annuity may provide the annuitant with a substantial income. The combination of partially tax free income and the initial charitable deduction makes this agreement quite attractive.

Annuity rates can be offered for one or two people, and you may also receive an immediate income tax deduction. The principal passes to MOFGA after the lifetime of the income beneficiaries.

Follow these simple steps to make set up your Charitable Gift Annuity:

- Donate $25,000 or more in cash, securities or other property to MOFGA through our financial services at Bar Harbor Bank and Trust.

- You and/or your beneficiary receive fixed annual payments for life at a very attractive rate based on the age of the beneficiaries.

- You can begin receiving payments immediately (if you are 50 or older) or defer payments for a year or more, and may be eligible for an immediate tax deduction.

- If you plan to restrict the use of your bequest (designating to a specific area or program), please contact MOFGA to ensure your wishes can be met. The more narrowly you restrict the use of your bequest, the greater the risk that the program you want to benefit today won’t be as vital or as relevant when we receive your gift in the future.

- MOFGA will welcome you to our Legacy Society, with Lifetime Membership and other rewards.

Graphic provided by Bar Harbor Trust Services.

For more information on this program, please contact the Director of Membership and Development, at 207-568-6013 or [email protected].